Acknowledgment is always on top: thank you DAO Research Collective, Joey and Seb from Fei, Lavi from Index, Stani from Aave, and all my fellow governance enthusiasts for making this piece possible.

Governance enthusiasts (random ordering): Hasu (Flashbot), Yuan (Blockchain Capital), Leland (Galaxy Digital), Brian (Mechanism Capital), Jeff (a16z), Guy (a16z), Josh (Llama), frogmonkee.eth (Bankless DAO), Cryptocrates (Delphi), Adam (Parafi), Jordan, Francis (Flipside Crypto), Shreyas (Llama), Larry and Derek (Reverie).

Introduction

The current focus on the Curve Wars has highlighted the important role metagovernance can play in crypto. However, despite so much focus on this one particular example, metagovernance can operate in a host of ways with far greater ramifications than the Curve Wars suggest. In this post, I will explore the possibilities of metagovernance by introducing the general metagovernance space and its roots in the traditional world and performing a dive-deep into a specific metagovernance event that happened with Fei-Index-Aave. Lastly, I will piece these together and discuss the implications and future considerations for protocols.

Curve War TL;DR

Essentially, the Curve War(s) is an ongoing event where different parties fight for Curve voting power in order to bootstrap liquidity, deepen liquidity, increase yield, and fulfill other self-serving purposes. These parties try to achieve these goals through directing liquidity rewards with veCRV voting power on the gauge (where the rewards come from). If you’re not following what I’m saying, don’t worry. For a refresher on Curve Finance and veCRV, here is Curve Finance’s ‘Understanding Curve’ page, and here is Curve Finance’s explanation on Staking Curve (where veCRV comes from). Knower also has an excellent piece on this.

Back to the story. Common ways to control voting power include buying tokens from the market, issuing synthetics + pooling LPs (cvxCRV), bonding through treasury (Redacted), and bribing (Spell) and prominent players include: Convex Finance (>50% of voting power on Curve), Yearn (>5B TVL), Votium, Redacted Cartel, Frog Nation, and many others.

Metagovernance & TradFi

First, let’s define metagovernance in crypto.

For the purposes of this essay, we'll define metagovernance as holding one DAO’s token in order to influence decisions in another DAO(s). This is not something newly created by DeFi. We can see its roots in TradFi. It is called investment stewardships.

Investment stewardship refers to the responsible oversight of capital that an institution allocates on clients’ behalf.

Investment stewardship is needed because these firms control large voting power. Currently, major investment firms (institutional funds and mutual funds) hold a large chunk of voting power (equity shares) in most companies in the public market. For example, 59%, 59%, and 43% of shares in Apple, Amazon, and Tesla respectively are held by institutions. These institutions normally have dedicated teams actively voting on governance proposals on behalf of their clients.

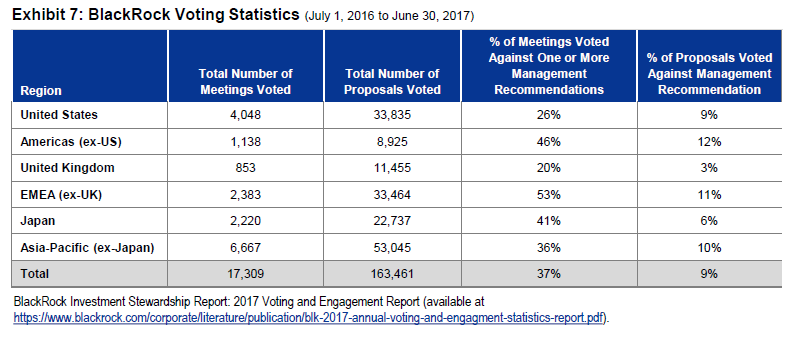

Investment stewardship is a complicated business. Vanguard and BlackRock are the two largest institutional holders.The table below is a breakdown of BlackRock’s voting summary from July 2016 to July 2017. In this time period, BlackRock voted a total of 163,461 times and voted against management’s recommendation 9% of the time.For Vanguard in the first half of 2021, it voted 137,826 times (275,652 annualized) on 734 companies, representing $1.9 Trillion in share value.

However, when you decentralize the duties of the investment stewardship teams within these organizations, you get metagovernance. A shareholder of BlackRock cannot easily influence how BlackRock will vote in Tesla’s new proposal. But a holder of Convex can easily influence how Convex will vote in Curve’s reward cycle next week. This opens the pandora's box of governance.

The first meta-metagovernance play

The first meta-metagovernance (metagovernance for short) play happened in the summer of 2021 when Fei Protocol utilized its $INDEX token to list itself onto Aave. The actual story tells us a lot more about metagovernance than the Curve War and gives a more nuanced picture of the metagovernance process we could expect in the future.

So, buckle up because we are going to take a trip down memory lane.

Introducing the players

Fei Protocol

$FEI is one of the few truly decentralized stablecoins because it is mostly backed by $ETH. Fei Protocol’s Protocol Controlled Value (PCV) holds ~$653mn, providing a 206% collateralization ratio for all circulating $FEI.

Index Cooperative (Index Coop)

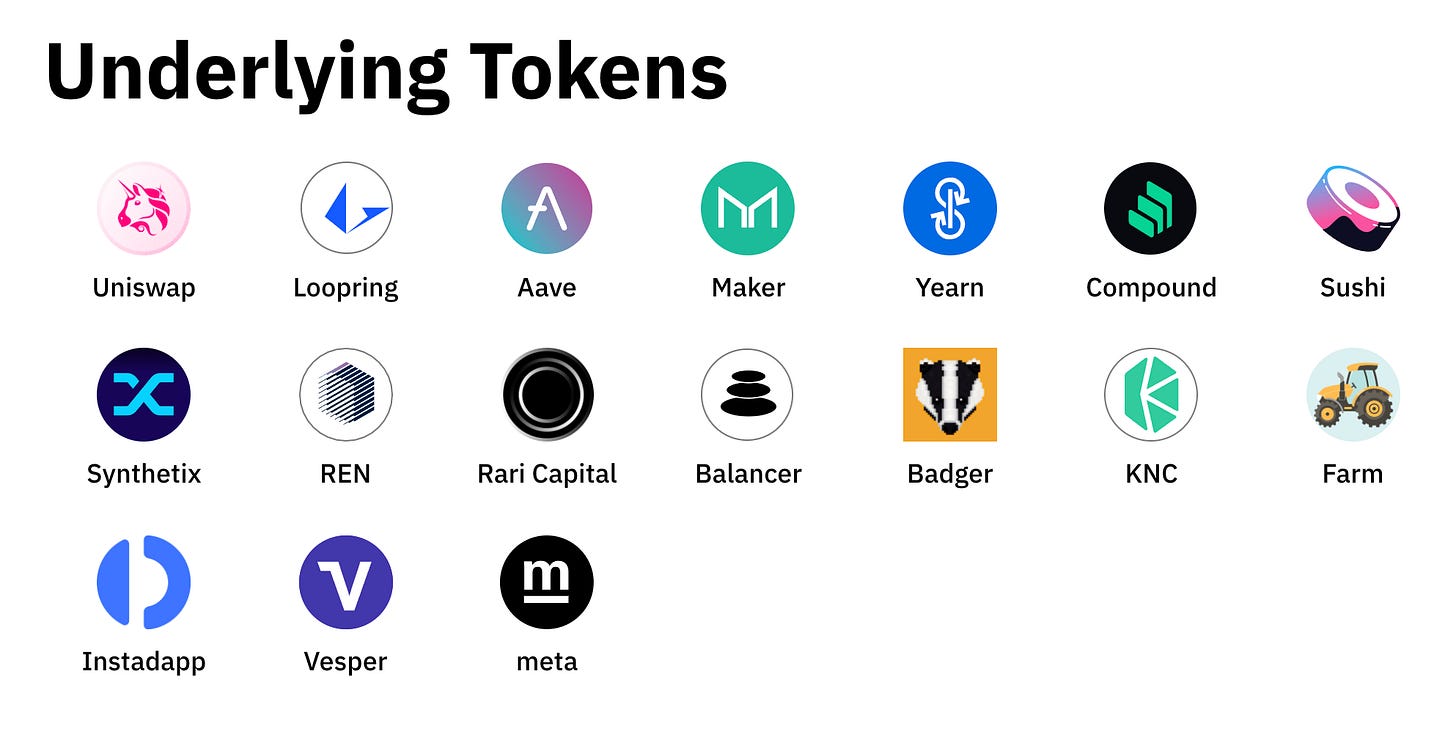

Index Cooperative is incubated by Set Labs. Index Cooperative offers a broad variety of investment vehicles to individuals and institutions – from token baskets (ETF-like) to leveraging. The most famous one is the DeFi Pulse Index ($DPI) which is an index token tracking a portfolio of major DeFi protocols. The $DPI launched in Sep 2020. $INDEX, Index Coop’s governance token, controls the governance rights for a portion of assets it holds.

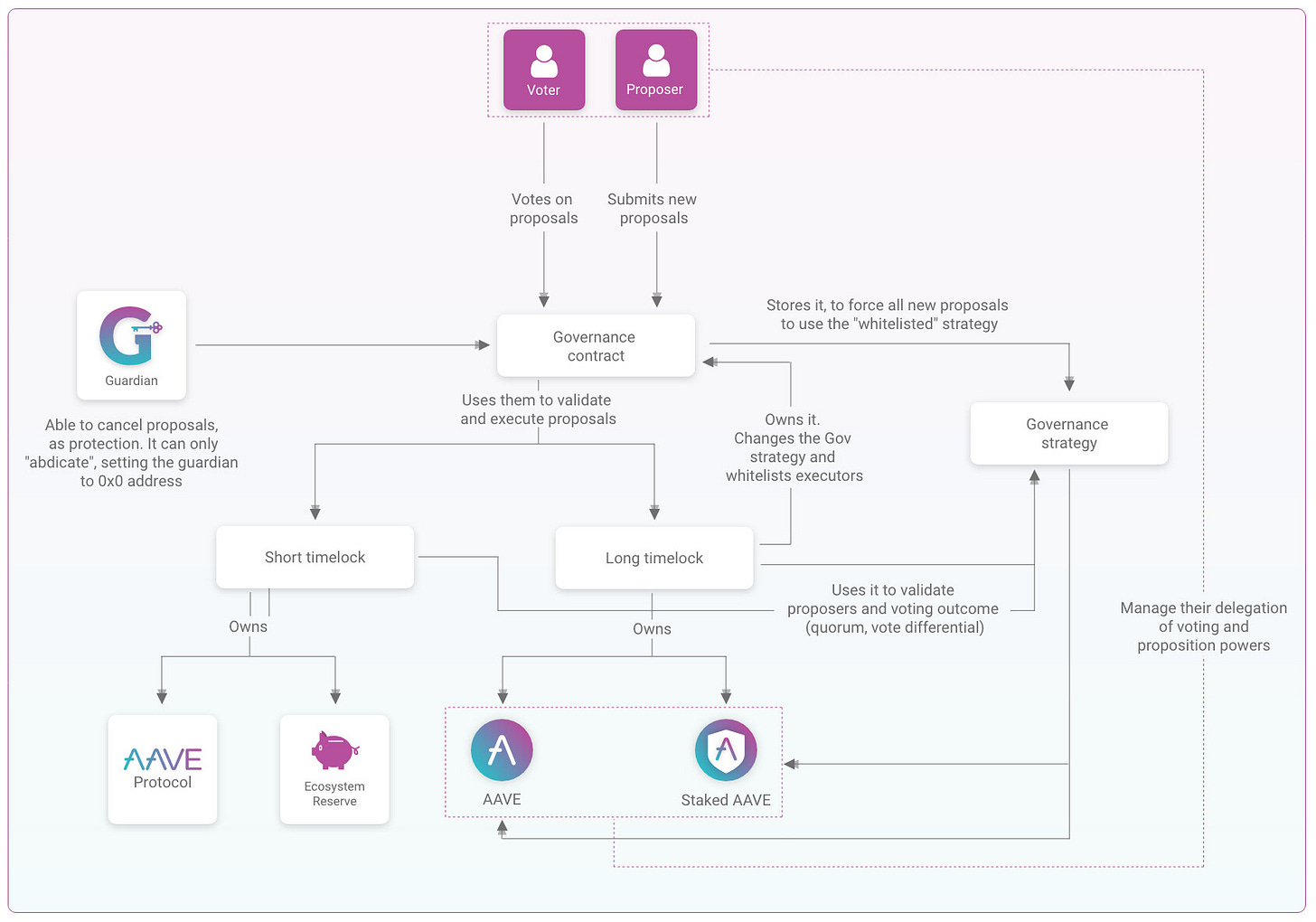

Aave

Aave is a decentralized non-custodial liquidity market protocol where users can participate as depositors or borrowers. As one of the OGs in DeFi, Aave has a predefined set of governance procedures to list new assets, implement rewards, change permissions, and parameter tuning.

Setting the stage

It’s June 21, 2021, two months after the launch of Fei Protocol. Brianna (a member of the core team at Fei Protocol) posts an ARC on Aave’s governance forum to list $FEI on Aave’s lending market. ARC stands for Aave Request for Comments. It is the first step in the Aave governance proposal process, a vital step for Fei Protocol as it will lead to them being listed on one of the largest lending protocols.

Along with the ARC, a Snapshot is also created to gauge Aave’s community sentiment towards the proposal. You can think of the ARC and the Snapshot as follows: they are both used to get a sense of the community’s view on the proposal - the ARC is used to get a qualitative measure and the Snapshot is used to get a quantitative measure.

Although anyone can post an ARC on Aave’s governance forum, not everyone can propose an AIP, Aave Improvement Plan. And an AIP is what you need to push the changes on-chain. To propose an AIP, you would need 80,000 $AAVE tokens (owned or delegated). 80,000 $AAVE is worth $20M dollars at a value of $250/AAVE.

This poses a challenge for the Fei Protocol: Where were they supposed to get those $AAVE tokens to propose their listing? A few options spring to mind:

Buy them OTC.

Lobby major $AAVE holders to propose the change.

Bribe holders.

Borrow it from somewhere*.

????

*Fei Protocol could also technically borrow voting power itself (i.e. Paladin), but these are early days and this isn’t an applicable technique yet.

Of these options, lobbying appears to be the most reasonable option. Buying the tokens OTC would seem like a waste for just one proposal. Bribing holders with $TRIBE would rely on mercenary voters and could lead to bad PR for the protocol. Borrowing faces similar risks to bribing. And so lobbying major holders of $AAVE seems like the most financially efficient way to get tokens.

However, lobbying faces its own challenges: it’s time-consuming for the Fei Protocol’s team and would entail multiple rounds of calls with different stakeholders. The entire process could take from weeks to months. Not only that, but Fei has recently gone through a huge de-pegging event, making successful lobbying considerably less likely. So, is there a more productive way?

Starting the chain reaction

While Fei Protocol is thinking hard about this problem, another proposal, unrelated to the issue, is proposed by Bruno and Matthew Graham. In this proposal, Bruno and Matthew list their reasons for adding $DPI to Fei Protocol’s PCV for diversification. At the end of the proposal, the authors mention something on the side:

Additionally, we would like to know the community’s initial impression on also buying INDEX, the governance token of Index Coop… The benefits would be taking advantage of meta-governance and having influence in a project that is well structured and growing fast in DeFi.

Why is $INDEX important to metagovernance? Around the time of the proposal, DeFi Pulse Index holds more than $100M in major blue-chip DeFi tokens, which importantly includes in excess of 100,000 $AAVE tokens. Remember, Fei Protocol only needs 80,000 $AAVE to propose the AIP. Luckily, $AAVE is one of the six tokens that $INDEX token holders can use for metagovernance. So, if you control $INDEX, you control the governance power of those $AAVE tokens.

This starts a chain reaction. Just three weeks before this proposal, the Fei community discussed Fei DAO’s investment philosophy and mentioned the future usage of metagovernance in PCV. The $INDEX collaboration comes at the perfect time. The community welcomed the idea with open arms. From reading the discussion under the proposal, we can see a few contributors were even more bullish on the $INDEX purchase than the $DPI purchase.

After a month of planning and coordination, Fei Protocol decides to buy 100k $INDEX (~$4M) from DeFi Pulse through a token swap. Why 100k $INDEX? Because it is the number of tokens required to reach quorum on Index Coop’s governance proposals. With 100k $INDEX, Fei Protocol can pass an IIP (IndexCoop Improvement Proposal) without the need of other parties. Now, Fei Protocol utilizes ~$4M to move $20M in voting power. A perfect example of metagovernance.

Of course, if no one votes heavily against them.

Firework

With 100k $INDEX at hand, Fei Protocol is just a few steps away from listing itself on Aave. Matthew, a core contributor at Index Coop, alongside the Fei Protocol’s team handles most of the interactions from this point:

Fei community will propose to use its $INDEX to propose on Index Coop.

Fei community will propose IIP-82: use its $AAVE to list $FEI on Aave.

Index Coop will propose AIP-33: list $FEI on Aave.

If all of those proposals are passed, $FEI is on Aave!

All three proposals pass successfully, and Fei Protocol is listed on Aave at the end of September 2021, three months after the initial ARC.

In the chart above, I summarize the entire event. There are five main interactions that happen among contracts and people. Three of them were fully on-chain and two were mainly off-chain. The amazing thing is that nothing new happened here. Every interaction is within the bounds of expectation. However, when you combine them, completely new and unexpected possibilities open up.

Bringing it all back

The Curve War and the actions taken by Fei Protocol and Index are distinctly different events. However, both fall under my definition of metagovernance - holding one DAO’s token gives you the power to influence decisions in another DAO. The main difference between the two seems to lie in motive. I think most people in the Curve Wars believe that financial return will bring protocol long-term success. We can see this through the normalization of bribing and the goal to “max boost your return.” For Fei Protocol and Index’s metagovernance event, the belief is that strategic collaboration wins in the long term. By listing $FEI on Aave, there’s little to no immediate benefit for the protocol or the token holders but huge potential long-term benefits.

In the end, metagovernance is just a tool used by DAOs to achieve their goals. Different DAOs can use it to pursue success in their own ways.

Comparing metagovernance in crypto and in the TradFi world, the difference is stark as well. This is in part due to DeFi’s nascency but also because the mechanism designs are different. In TradFi, you cannot influence BlackRock’s votes in its ETFs with BlackRock’s shares. But in DeFi, Fei Protocol can have an influence on Index's governance, and therefore on all meta governance votes Index has enabled through DPI.

For contributors, founders, and teams…

I am optimistic about what metagovernance can bring to the crypto world and also to the human collaboration game. However, many concerns remain. In the Fei-Index-Aave example, Fei Protocol’s main goal in purchasing $INDEX was not for metagovernance but for long-term collaboration, as seen by the continuous hodl behavior on Fei’s side ($INDEX token price has been down only). Fei Protocol’s intention is a long-term collaboration with the Index community.

However, intention is not code and intentions can change.

Let me give you a highly-likely example:

Protocols A and B are in adjacent industries and both teams see the synergy between the two if they cooperate. To deepen ties, A and B do a token swap. So now, A holds $B, and B holds $A.

Suddenly, A gets hacked. Now $A is dropping like crazy, and a proposal is put on B by the community: “Given the current price action of A, we should sell A to salvage our treasury.”

How should this be handled?

Another highly-likely example:

A and B do a token swap and a bear market hits. Both $A and $B are down 50%, and A feels like it might drop further. In order to salvage their treasury and accumulate more stablecoins for the bear market, A sells $B.

As amazing as the Fei-Index-Aave metagovernance play is, there are a lot of hidden traps, and other protocols should not get into these plays without careful deliberation.

What you should learn from the Fei-Index-Aave play?

Fei only holds a small stack of $INDEX compared to their total treasury (less than 1%). This alleviates any urge to sell because it is just so small.

Fei engaged Index for more than a one-off collaboration. Their intention is never, “Oh, let’s use Index’s Aave for this proposal.” Their intention is, “I want to work with Index and its ecosystem.” And it just so happens that its $INDEX holding is enough to propose the AIP.

Fei went through their governance process on everything. When doing a token swap, you should engage with the community and clearly communicate your goals. This is important for two reasons: 1) the community would understand future decisions if problems arise and 2) by stating your purpose publicly you promote transparency, reducing the probability that you or others act “differently.”

What could Fei have done better?

Codify this interaction: make it (smart) contractually clear when and under what conditions $INDEX can be sold, so that it can only be sold when those conditions are met. In Fei’s case, since all PCV is backing $FEI, if the collateralization rate falls below a certain value, Fei should be able to sell its $INDEX.

Closer interaction with Index: there are hundreds of proposals listed on Index and it would be impossible for Fei to be aware and vote on all of them. How should Fei’s $INDEX be used in this case? Delegation might be a good answer here.

Fei was operating a full stablecoin protocol while working with Index on this first-of-a-kind metagovernance proposal. They were resource-constrained and did not have time to consider everything. However, when using Fei Protocol’s playbook, other DAOs should take these into consideration to maximize the collaboration with their metagovernance counterparty.

Final words on metagovernance and governance in general

The Curve War is interesting but represents just one type of metagovernance, and there is no doubt that we will see more intricate metagovernance plays in the future. Metagovernance, like governance itself, is a double-edged sword. If not used carefully, the abuse of otherwise helpful structures can be extremely detrimental. I will not share explicit attack avenues here in this post, but the recent TrueUSD controversy with Compound should raise alarms for other protocols that might be vulnerable to meta-level influences.

Governance has never been easy. And, since our structures are very different from the current governance structures in the TradFi world (mainly because in crypto, our governance decisions have direct operational impacts), the opportunity exists for completely new modes of governance that could have a great positive impact. I hope this piece sparks your interest in governance. Unlike interest in DeFi, interest in governance is hard to translate into financial gains in the short term but, when it comes to long-term growth and viability, the possibilities are huge. We need more people like you who think critically and let us all keep innovating and experimenting (safely).

References

Index: IIP-82: Use IndexCoop’s AAVE holdings to list FEI on Aave V2

Aave: Governance - Voting, Delegating & Proposals in Depth [MarketMake]

Fei Protocol: FIP-14: Buying DeFi Pulse Index with Bonding Curve

Fei Protocol: FIP-15: Provide $18M DPI-FEI Liquidity on SushiSwap

Future Readings

Financial Disclosures

0xkydo.eth is Kydo’s only wallet address. It holds < $10,000 of the tokens mentioned in the piece. Kydo also received a retrospective grant from the DAO Research Collective for writing this piece.