PALM: Protocol-owned Active Liquidity Management

The next step for protocol-owned liquidity (POL)

Letter cruncher: 0xkydo

Data monkeys: andrewnhwang.eth, davidtsong.eth

Acknowledgement is always on top: thank you Hasu, Gabriel Bianconi, John Morrow, Yuan Han Li, Omnom, Brian, Chuddy, David Iach, Wayne, BP for commenting on the paper and sharing your insights.

Abstract

From the beginning of DeFi summer in 2020, the native token liquidity problem has always been center stage. Since then, solutions to this problem have evolved many times. Last year, OlympusDAO’s bonding mechanism introduced protocol-owned liquidity. Many other protocols have adopted their design since then.

In this article, we build on top of previous designs and propose an innovative solution for this problem - PALM: protocol-owned active liquidity management. PALM combines the advantages of protocol owned liquidity (POL) and active liquidity management (ALM) to give protocols sustainable and capital-efficient liquidity.

Background

First, let’s start with the basics.

Liquidity mining

Liquidity mining campaigns can secure temporary liquidity, but have shown to incentivize mercenary behaviors (Loon 2021,Wu 2021). For most projects' early stages, protocols would pay liquidity providers (LPs) on a per block per dollar basis in order to bootstrap native token liquidity. This can be viewed as renting liquidity from others (OlympusDAO 2021). The rent is paid out in native tokens. When the token price is high, the rent is good and people want to provide liquidity. However, when the token price drops, the rent decreases as well. Then providing liquidity becomes less attractive, LPs withdraw, and liquidity dries up - leading to the death spirals (aka negative reflexivity).

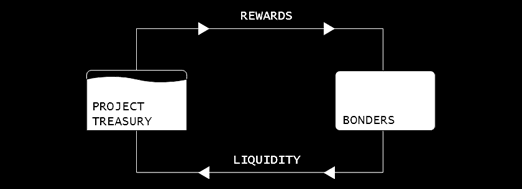

Protocol-owned liquidity

Protocol-owned liquidity (POL) emerged this summer as a way to tackle the native token liquidity (pool 2) problem. Instead of renting liquidity on a time basis, OlympusDAO captures pool 2 liquidity through its bonding mechanism where they exchange their treasury's native token at a discount for permanent LPs. Now, since protocols own their liquidity, drops in token price will not cause liquidity to dry up, dampening the negative feedback loop.

Olympus Pro utilizes this design to help other projects capture their liquidity. Currently, 20+ projects are participating and OlympusDAO has helped them bond more than $40mn in liquidity (Recorded on Jan. 22, 2022).

We believe in the future, most protocols will own some amount of their native token liquidity. The amount needed for each protocol might be different but POL is needed.

Current Challenges with POL

Owned liquidity is not capital efficient.

The current bonding system, which most protocols use to accumulate liquidity, focuses on Uniswap V2 LP tokens. As many analyses have noted, Uniswap V2's capital efficiency is much lower than V3 (Tien 2021, Uniswap Team 2021). For example, providing liquidity +-10% around the current price point on Uniswap V3 could yield more than 20x capital efficiency compared to Uniswap V2.

They can just switch to Uniswap V3, right?

Uniswap V3 is hard to manage

Uniswap V2 on leverage = Uniswap V3

Providing liquidity on V3 is risky. LPs must perform in depth calculations and analysis to profitably set the upper and lower bands for their concentrated liquidity. From a recent analysis by REKT, we know that more than half of the LPs on Uniswap loses money (Anon 2021). Some people also compared LPing on V3 as “LPing on V2 with leverage” (Erins 2021). Essentially, V3 LPs are leveraging up on divergence costs for more trading fees. Therefore, it takes specialized domain knowledge to safely navigate through this high risk and high rewards environment without losing money.

LP management is time consuming

Since providing liquidity on Uniswap V3 requires constant monitoring and management, a protocol would need dedicated team members to focus solely on LPing. This is a big ask because most protocols do not have these dedicated members and recruiting them could be extremely difficult.

So, is POL + Uniswap V3 not possible? It is possible. ALM can help with that.

Active Liquidity Management (ALM)

ALM automates away the time-consuming tasks required to manage LP positions and deploy strategies to navigate the high-risk environment in Uniswap V3.

ALM projects include Visor Finance, Charm Finance, Popsicle Finance, and many others. *We will use ALM and ALM projects interchangeably from here.

Most ALMs work as the following:

1) You deposit tokens into a smart contract and receive LP tokens, representing your share in the pool of assets.

2) The strategy contract is managed by ALMs to move user funds into different ranges of a pool.

3) You burn LP shares and redeem original tokens back* pro rata of the pool.

* Most ALMs make money through a 10% cut of the fees generated.

Downside when using ALMs

ALMs sound amazing. But when using something new, we want to understand the risk and downsides involved with it. For ALM, its main downside is a lack of financial return.

Many ALMs do not provide the best financial returns for users. Currently, Charm Finance’s Alpha Vault is one of the top performing ALMs. However, when looking at the graph above, we can see that the orange line is mostly above the blue line, meaning the vault is performing worse than just LPing on V2.

We see this with other ALMs as well. For example, based on our analysis of Visor Finance, more than 50% of people who have entered and exited a position from June 2021 to Jan 2022 on Visor lost money. Notably, the bottom 10% losers lost more than three times of the top 10% winners.

Protocols don’t mind the return

Users care about financial returns. But do protocols care in this case? The answer is no.

Subpar returns are acceptable for protocols since the main goal with POL for protocols is not to make a profit, but to provide utility for the token holders. The impermanent loss in this case is fine because they are getting the liquidity benefits.

Therefore, for a protocol to move POL from V2 to V3 with an ALM, the cost is minimal when compared to the benefits of the increased capital efficiency and sustained liquidity.

Upside when using ALMs on Uniswap V3

One benefit of providing liquidity on V3 is the increased ability to absorb volatility for the same size of capital. Sharp price movements might impose a lot of stress on the protocol and also on the team. Therefore, a smooth price discovery in either direction is beneficial.

To test volatility absorption, we ran a backtest from the beginning of 2021 on all Ethereum protocols with a market cap >$150mn and >10% trading volume on Uniswap/Sushiswap. We calculated price volatility on Uniswap pools based on different V3 LP assumptions. We found that concentrated positions on V3 can reduce volatility by up to 90% compared to V2.

PALM = POL + ALM

Combining POL and ALM together, you have PALM (Protocol-owned Liquidity Management) - a great tool to combat the native token liquidity problem.

First, the POL portion substantially reduces the mercenary behavior in liquidity mining and dampens the negative reflexivity that kills a lot of projects. Major problem solved.

Second, the ALM portion makes the migration from V2 to V3 much easier for protocols. Reduces a lot of overhead.

Lastly, protocols do not care about ALM's financial return because its main goal with this capital was to ensure a smooth trading experience for the users and a healthy price discovery process for the protocol.

With PALM, the user journey is as the follows:

Users deposit two sides of the pool into a bonding program, X + Y.

Bonding program releases discounted tokens in a vested manner.

On the back end:

Bonding program periodically deposits X + Y into ALM.

ALM mints corresponding LP shares to the bonding program or to the protocol.

ALM manages X + Y on Uniswap V3.

We can see that under this schema, users would be only interacting with the bonding program similar to the old bonding program. The backend is handled by the POL and ALM service provider correspondingly.

Key considerations of ALM

Now if you are a protocol and want to shift some of your POL to an ALM, here’s a few considerations when working with an ALM. The graph below walks through them in detail.

ALMs must show great security. Many ALMs have been hacked in the past, including some of the largest ones. Therefore, security is paramount when working with an ALM. Some must-have features are complete ownership, protected withdrawals and deposits. These must-haves are learned from previous exploits. One nice-to-have is range limits, protecting against malicious behavior of the ALM to manipulate price.

What can ALM bring to the table? Since ALM is a service provider for protocols, ALMs should have detailed reports for the protocols on projected fee earning and volatility. Also, ALMs should have good documentation to help protocol developers build their own integrations. Working with an ALM should not be too much extra work for the protocol devs.

The bonding process is easy to use. If users are involved in the ALM process, the entire user journey should be easy to understand and require few transactions on chain. Also, when users deposit assets into an ALM, they should be able to track it with different wallet aggregators such as Zapper, DeBank, etc.

Limitations and discussion

POL is not the final answer to the native token liquidity problem. As seen from a recent analysis of PoolTogether, two actors accounted for 80% of the bonding activities and one of them was a bot (underthesea 2021). Getting community participation in bonding remains an unsolved problem. Also, what is the liquidity target for bonding? Is there a number/percentage we want to hit?

ALMs may not always have subpar financial returns. At a high level, Uniswap V3 is launching on more L2s. This leads to lower transaction costs and may enable ALMs to boost their returns with newer strategies. New strategies -> higher returns? We will see.

ALMs could also introduce new dynamics into the price performance of the protocol. This could impact the market in unknown ways. The Bumper Finance’s Initial DEX Offering showcased this problem where price went out of range and the concentrated positions could not be rebalanced (@denzelpepewash 2021). One possible fix is through CrocSwap’s ambient liquidity model where 30% of the LP are always full range and the rest are concentrated and managed (CrocSwap 2021).

Conclusion

We hypothesize that PALM will become more mainstream because of the unsustainable nature of liquidity farming and the capital inefficiency of Uniswap V2.

POL and ALM are still less than one-year-old in DeFi. More security bugs and incentive misalignment probably will appear. However, I am excited to see how this space will evolve alongside things I did not mention in the post, specifically the amazing innovations happening in the general Liquidity-as-a-Service space.

About the Authors

0xkydo.eth - ponzumonimist writing about incentive design and governance. twitter @0xkydo

andrewnhwang.eth - stanford CS memer building in zk-snarks and defi. twitter: @andrewnhwang

davidtsong.eth - stanford CS memer building in crypto tooling and defi. twitter: @davidtsong

*Authors own small positions in UNI and VISR.

References

Anon. 2021. “Uniswap V3 LP.” Rekt News. https://rekt.news/uniswap-v3-lp-rekt/.

CrocSwap. 2021. “CrocSwap Whitepaper.” CrocSwap. https://crocswap-assets-public.s3.us-east-2.amazonaws.com/CrocSwap_Whitepaper.pdf

@denzelpepewash. 2021. “Bumper Finance IDO.” Twitter.

Erins, Peteris. 2021. “Impermanent Loss in Uniswap V3.” Medium. https://medium.com/auditless/impermanent-loss-in-uniswap-v3-6c7161d3b445.

Loon, Ling Y. 2021. “All Hail MasterChef: Analysing Yield Farming Activity.” Nansen. https://www.nansen.ai/research/all-hail-masterchef-analysing-yield-farming-activity.

OlympusDAO. 2021. “Introducing Olympus Pro.” OlympusDAO – Medium. https://olympusdao.medium.com/introducing-olympus-pro-d8db3052fca5.

Tien, Shaoku. 2021. “Uniswap v3 Features Explained in Depth.” Medium. https://medium.com/taipei-ethereum-meetup/uniswap-v3-features-explained-in-depth-178cfe45f223.

underthesea. 2021. “Olympus PRO - 30 days analysis.” PoolTogether. https://gov.pooltogether.com/t/olympus-pro-30-days-analysis/1831.

Uniswap Team. 2021. “Introducing Uniswap V3.” Uniswap. https://uniswap.org/blog/uniswap-v3.

Wu, Eva. 2021. “The Art and Science of Native Token Liquidity.” Mechanism Capital. https://www.mechanism.capital/native-token-liquidity/.

Notes:

Visor Finance was recently renamed to Gamma Strategies.

Why no comment?

so what's the roadblock for protocols to adopt PALM? is it mainly a business development problem? have you talked to protocols about this - why are they hesitating (if they are)?

and would this be something you'd be interested in actively working on (working with liquidity management protocols to get protocols to adopt)?